Introduction

In an era when every individual is tech engaged and every organization is tech enabled, CompTIA is the leading destination for both. As an association dedicated to innovation, CompTIA unifies learning, advocacy and career networking in a welcoming, forward-thinking place. We are the connected global community of informed advocates, championing modern technology (and the people who advance it) one day, one deployment, one discovery at a time. CompTIA is tech forward.

CompTIA designed Cyberstates to serve as a reference tool, making national, state, and metropolitan area-level data accessible to a wide range of users. Cyberstates quantifies the size and scope of the tech industry and the tech workforce across multiple vectors. To provide additional context, Cyberstates includes time-series trending, average wages, business establishments, job postings, gender ratios, innovation and emerging tech metrics, and more. For the interactive, online version of Cyberstates, visit www.cyberstates.org.

As with any sector-level report, there are varying interpretations of what constitutes the tech sector and the tech workforce. Some of this variance may be attributed to the objectives of the author. Is the goal to depict the broadest possible representation of STEM and digital economy fields, or a more narrowly defined technology subset? Is the goal to capture all possible knowledge workers, or a more narrowly defined technology subset? For the purposes of this report, CompTIA focuses on the more narrowly defined technology subset. See the methodology section in the full PDF report for details of the specific NAICS codes and SOC codes CompTIA uses in its definitions of the tech sector and the tech workforce.

Due to periodic updates to industry and occupation categories by the U.S. Bureau of Labor Statistics, as well as occasional revisions of historical data, direct comparisons to previous publications of Cyberstates is not always possible. Additionally, CompTIA adjusts its methodology at times to best reflect available data and the needs of users. For these reasons, it is best to view the most recent release as the best representation of the state of the tech industry and workforce. If historical comparison data is required, requests can be submitted to [email protected].

National Snapshot

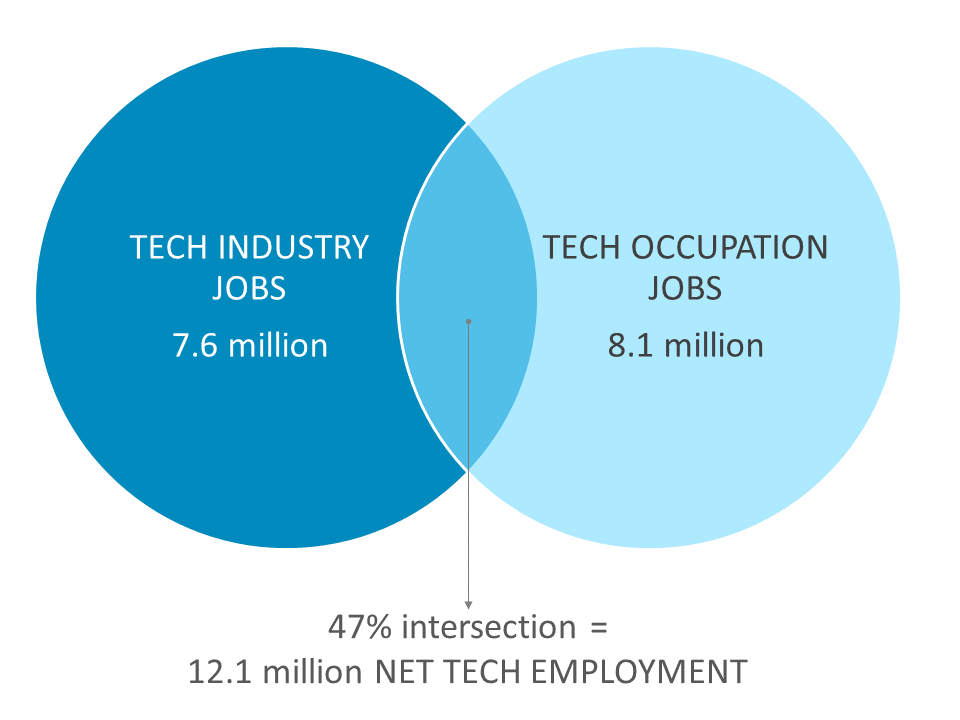

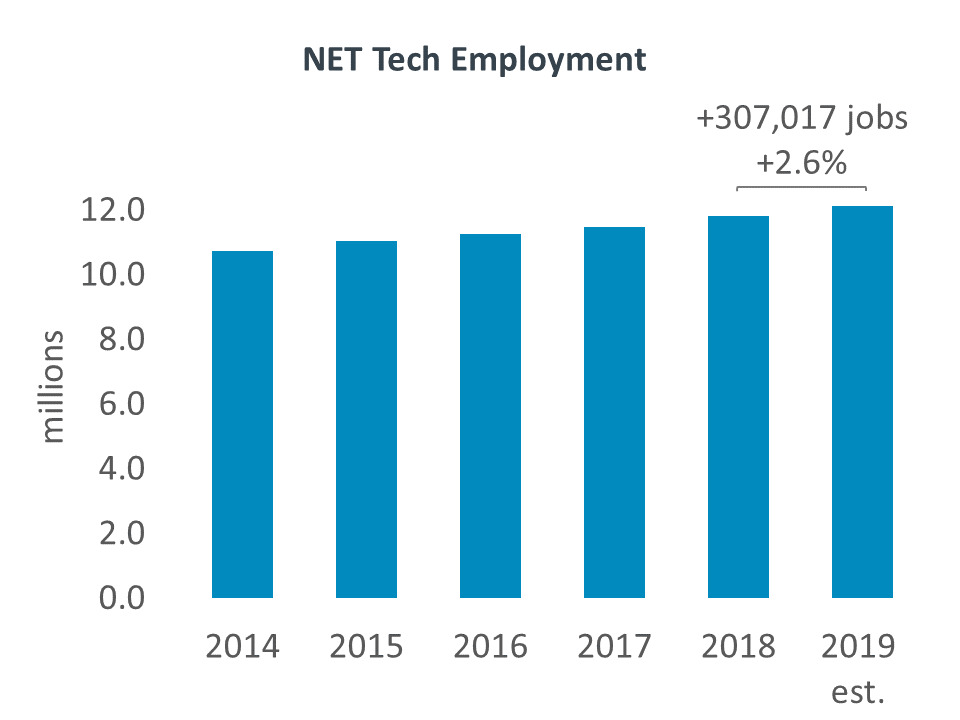

- U.S. net tech employment totaled an estimated 12.1 million in 2019, an increase of more than 307,000 workers over the 2018 base of 11.8 million. Net tech employment grew an estimated 2.6 percent year-over-year.

- Net tech employment accounted for approximately 7.7 percent of the overall U.S. workforce in 2019. As noted previously, because of the blurring of lines across industries, there is a degree of undercounting in tech sector employment.

- U.S. tech industry employment totaled an estimated 7.6 million in 2019, an increase of 183,033 workers from 7.4 million in 2018. Tech industry employment grew an estimated 2.5 percent year-over-year. As noted, tech industry employment is a subset of net tech employment.

- The IT services and custom software services subsector generated the largest numerical gain in employment, adding more than 85,000 net-new jobs in 2019. This gain of 3.2 percent increased the employment base to 2.7 million. This growth reflects the ongoing digital transformations occurring across the economy and the corresponding need for expertise in areas such as cloud computing migration, application integration, process automation, data analytics, and cybersecurity.

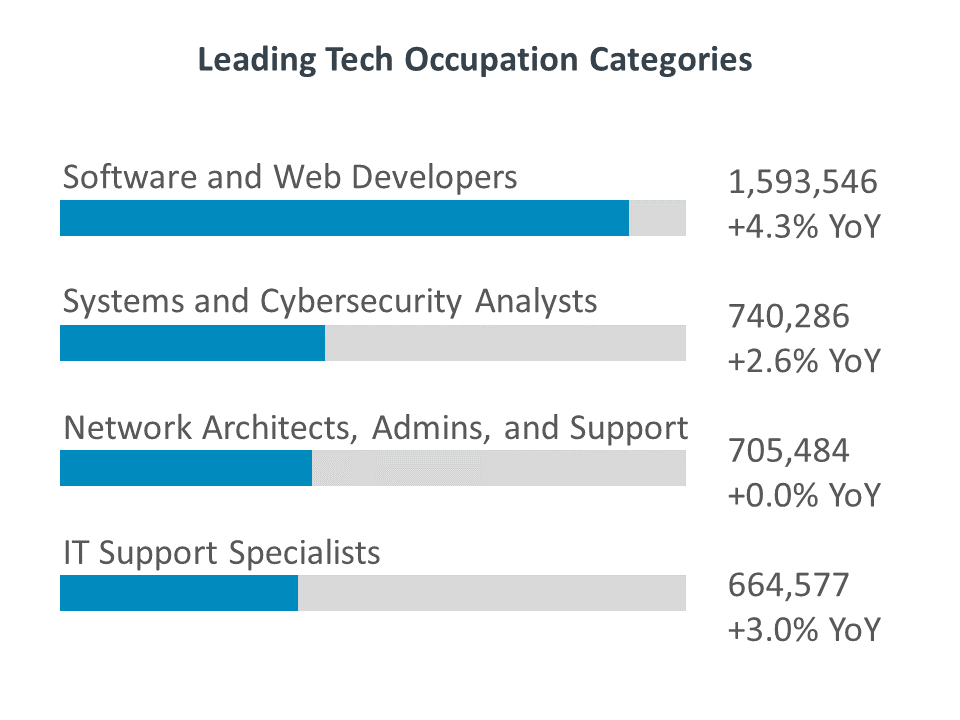

- Tech occupation jobs reached an estimated 8.1 million workers in 2019, an increase of 187,024 workers over 2018. On a percent change basis, the rate is on par with the annual growth rates experienced over the past several years, with the exception of the 2015 rate, which exceeded 3.6 percent.

- Since 2009, nearly 1.8 million new tech occupation jobs were added, a function of the demand for tech talent across every industry sector in the economy.

- The IT occupations segment of tech occupations accounts for 64 percent of the total. IT occupations added over 139,000 net-new jobs in 2019, a year-over-year growth rate of 2.8 percent. On a numeric basis, software developers, systems analysts and cybersecurity analysts, network architects, and IT support specialists recorded the largest gains in employment. The U.S. Bureau of Labor Statistics does not yet break out many emerging tech roles, other data sources indicate these new specialties are starting to make meaningful contributions to the growth of the tech workforce.

State Overview

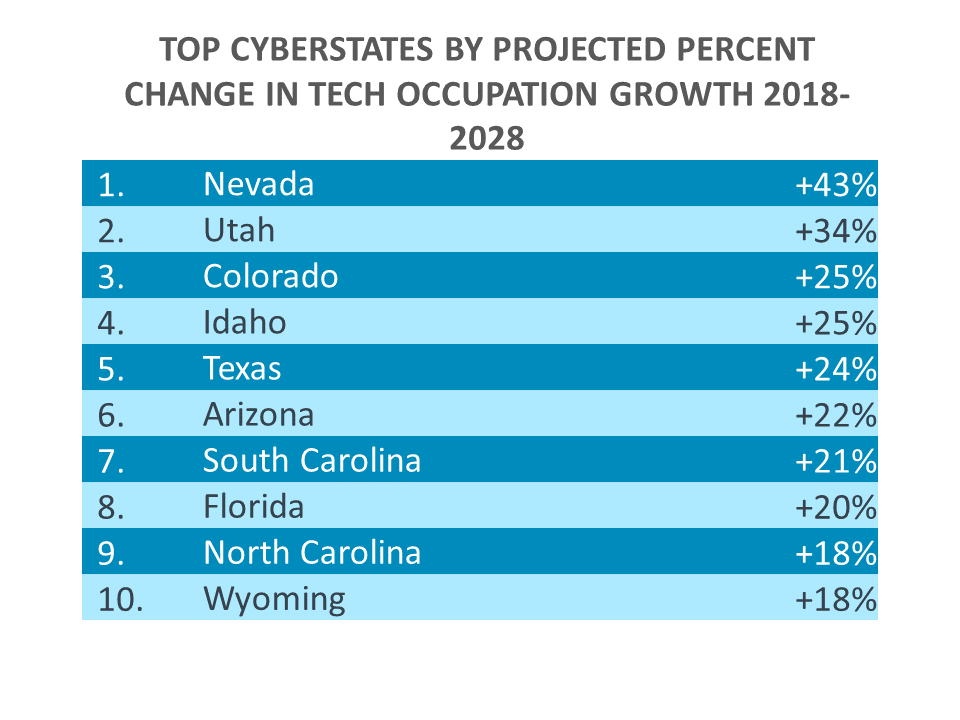

- Forty-six states generated positive tech employment job growth in 2019. While the largest job gains are associated with the states with a significant tech presence, the fact that most states experienced tech employment job gains speaks to the broad-based impact of technology across the nation.

- Job gains in tech employment have grown steadily over time. Over the span of the recent decade, 46 states experienced positive tech employment gains. Twenty-four states generated gains of more than 25,000 net new tech jobs during this stretch, while six states topped the 100,000 mark for tech job additions.

- On an industry sector basis, the IT services and custom software services has been the growth engine for the greatest number of states over the past few years. This is both in response to as well as an enabler of the ongoing digital business transformation trend.

- According to data from the Pitchbook-National Venture Capital Association (NVCA) Venture Monitor, venture capital investments flowing to the software category increased 14 percent in 2019 year-over-year, pushing the category total to $17.2 billion. The IT hardware category increased 35 percent to $2.0 billion. Many VC investments in other categories, such as media, healthcare, or commercial services, are in startups that often have a strong technology and data component, so the figures tend to understate the true impact of tech.

- Forty-eight states added to their base of tech business establishments. On a numeric basis, California had the largest year-over-year increase of net-new tech business establishments (+2,287). Rounding out the top five for net-new tech business establishments were Texas, Arizona, Florida, Wisconsin, and Missouri.

Metropolitan Statistical Area Overview

- The top ten metropolitan areas employ a little more than 4 million tech industry and tech occupation workers, or about 1 in 3 tech workers in the nation.

- New York City is the largest metropolitan area in the country by a wide margin. It follows that it also has the largest base of tech employment.

- Silicon Valley continues to be a critically important hub for innovation. Between San Francisco and San Jose, nearly 37,000 net tech employment jobs were added over the past year. The discussion doesn’t end there, however, as technology increasingly has a significant presence across the nation. Cities such as Boston, Seattle, New York, Dallas, Atlanta, Los Angeles, Denver and more, boast sizable tech workforces and notable job gain rates. This includes the sometimes “under the radar” tech cities of Austin, Raleigh, Charlotte, Phoenix, Detroit, Orlando, and more.

- Employment concentration provides a measure of tech employment relative to employment across all the other industry sectors in a local economy. Along with economic impact as a percentage of a local economy, these metrics help to put tech into context.

- At 33 percent, San Jose has the highest concentration of net tech employment as a percentage of its overall employment base. Similarly, San Jose is an outlier in the economic impact of tech to the local economy at nearly 60 percent, about twice the rate as the next highest metro area.

- Compared to the national tech employment concentration benchmark of 7.7 percent, 28 metro areas had a higher rate, confirming the importance of technology to a far-reaching set of cities across the country.

Read more about Industry Trends.

Download Full PDF

Download Full PDF