How’s this for a fun fact? More than 99% of all businesses in the United States are “small” by definition, employing fewer than 500 workers, according to the U.S. Small Business Administration. That adds up to a whopping 32.5 million businesses that employ 48% of the country’s workforce as of 2021.

Just sit with those numbers for a moment. Unless you work for the likes of an IBM or Microsoft, a Ford or Procter & Gamble, the odds are that you spend your professional hours each week at a small- to medium-sized business. These companies may garner far less attention than the corporate behemoths but, in fact, they constitute the backbone of the U.S economy.

And they have been evolving. Over the decades, small businesses from the family-run pizza shop with 10 employees to the 400-person strong sheet-metal manufacturing plant have upped their game in terms of efficiency, innovation, and sheer sales footprint. How have they done that? Short answer: technology. Whether that’s e-commerce platforms, point-of-sale solutions, robotics, or SaaS-based business applications, the democratization and ubiquity of IT has arguably had greatest impact on the SMB universe. No longer a nice to have, technology is a competitive must for even the smallest of the small.

And many of these firms know it. Consider the following: 62% of respondents in CompTIA’s latest research, SMB Technology Buying Trends, say the use of technology today is a primary factor in reaching their strategic business goals. Thirty-one percent deem tech a secondary factor in those critical efforts, with only 5% calling it a non-factor. This is coming off another unprecedented and difficult year of pandemic fallout and restrictions, which hurt small businesses particularly hard. (Note: CompTIA’s sample for this study defined SMB companies as those with fewer than 250 employees)

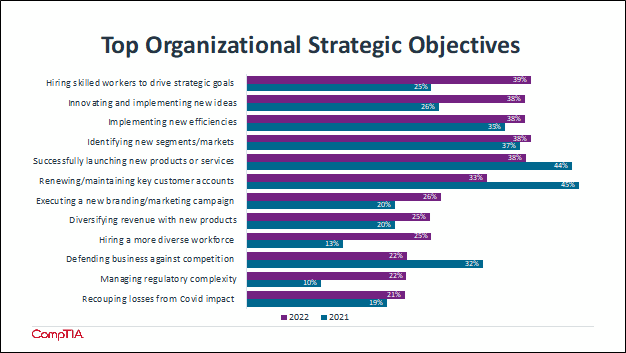

SMBs that have been playing mainly defense for the last two-plus years are starting to dust off their offensive playbook again. The past couple years of the pandemic have had SMBs mostly on their heels, doing their best to stay in business, avoid laying off staff, and holding onto customers. But now, business goals that were top of mind in 2021, for example, such as renewing or holding onto existing customers and defending against competition are taking a backseat to activities such as hiring skilled workers and implementing new ideas.

What’s notable is that this return to a strategic mindset identifies technology as the enabler and fuel to meet those goals. Last year, technology initiatives primarily focused on infrastructure, which was largely driven by the remote work migration many firms experienced overnight. Device purchases such as laptops, printers, and phones for staff became paramount, as well as collaboration, video, and communications/telecom solutions to better enable virtual work environments. This year, when asked where they would prefer to allocate tech spending, respondents shifted from infrastructure buying categories to investments in innovation and human resources. For example, 28% of SMBs want to spend on technology that boosts innovation, compared with 19% in 2021. And on the human side of the equation, those saying they want to hire additional tech staff and invest more in training and certifications this year is up significantly over 2021. Taken together, these aims signal a coming out of the bunker trajectory for SMBs looking to shake off the effects of the pandemic.

In general, these more aggressive business goals seem to map with more positive attitudes about the current state of their business. Three in 10 SMBs agreed that their company was thriving this far in 2022 by increasing revenue and profitability. That compares with 22% that said so last year. The bulk of firms describe their firm’s health as holding steady in terms of revenue and profit levels, which is similar to last year (51% in 2022, 48% in 2021). The number that report struggling this year, a net 19%, is down from 29% that said so in 2021.

Sounds like good news, right? It is, but also somewhat curious given the global economy gloom and doom issues of the summer of 2022. SMBs in the study do cite macroeconomic concerns as ongoing threats that worry them – continued inflation, potential recession, supply chain woes, etc. – yet seem to have adopted a more optimistic attitude nonetheless, perhaps due to the pandemic receding in terms of its day-to-day impact on running their shops.

That optimism extends to their opinions on their companies’ current tech budgets. About half believe spending levels are just about right, while a surprising 22% think it’s too high. A quarter don’t believe current tech spending is enough. The reality is that many of the strategic goals these firms are aiming for will require a higher level of investment in technologies than some SMBs realize. Why wouldn’t they know? The main reason is likely the fact that the smallest segment of SMBs often operate without a dedicated IT team on staff, which means many of the costs beyond a technology’s initial price tag can be overlooked. Those costs include training for staff on new technologies, integration work that will be needed to tie new systems or applications into the broader IT environment, and/or steps needed to ensure cybersecurity needs are met.

The gap between spending reality and real spending need is a perennial issue for SMBs who are constantly managing resource allocation. But if the strategic mindset about business goals and the role technology plays in attaining them continues apace as it is now, business owners will hopefully realize that committing to further investments will be key for success and help buttress them against another unexpected body blow such as the pandemic.

Want to learn more?

Check out Trends in Managed Services 2022

Add CompTIA to your favorite RSS reader

Add CompTIA to your favorite RSS reader